¨

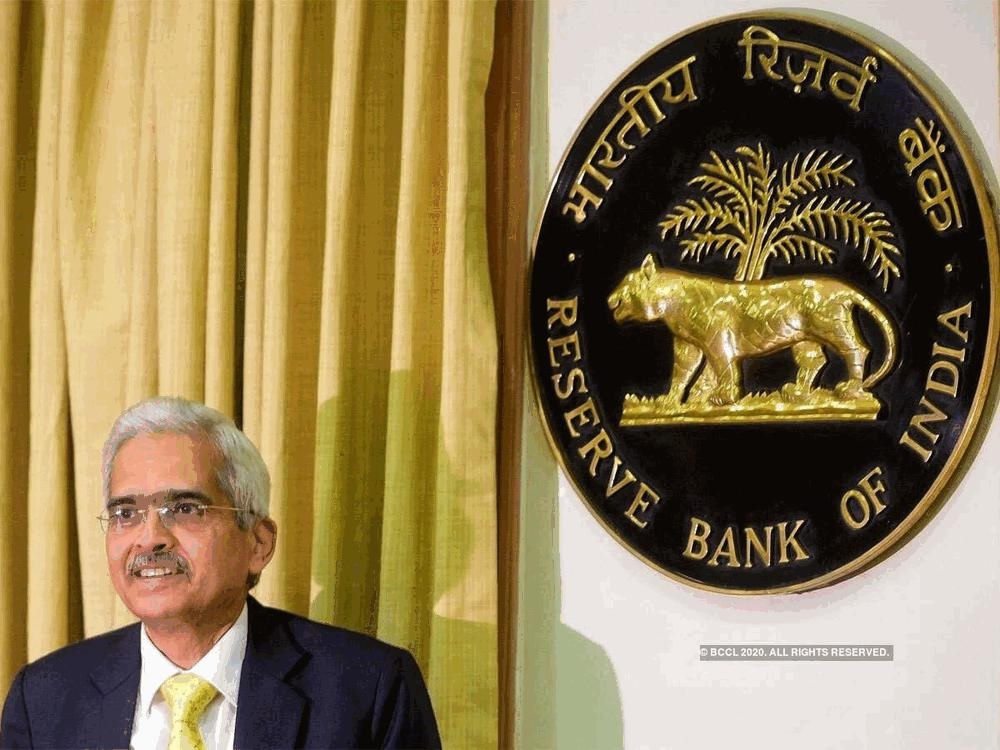

Reserve Bank of India has set a ₹50,000 crore limit on Ways and Means

Advances (WMA).

¨ This limit applies to the central government

for the second half of the 2025-26 financial year.

¨ WMA is a short-term loan facility provided by

the RBI.

¨ It helps the central, state governments, and

Union Territories manage temporary cash shortfalls.

¨ The limit was fixed after discussions between

the RBI and the central government.

¨ The RBI may begin fresh market borrowings

once 75% of the WMA limit is used.

¨ Both the RBI and the government can revise

the limit if needed.

¨ This decision can be based on changing

economic or fiscal conditions.

¨ The interest rate on WMA will match the

current repo rate.

¨

If the government exceeds the WMA limit, the overdraft rate will be 2%

higher than the repo rate.